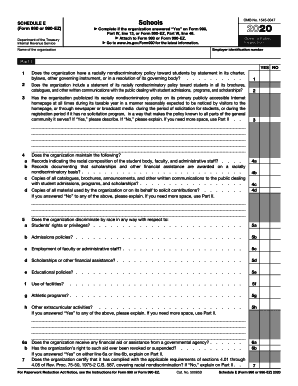

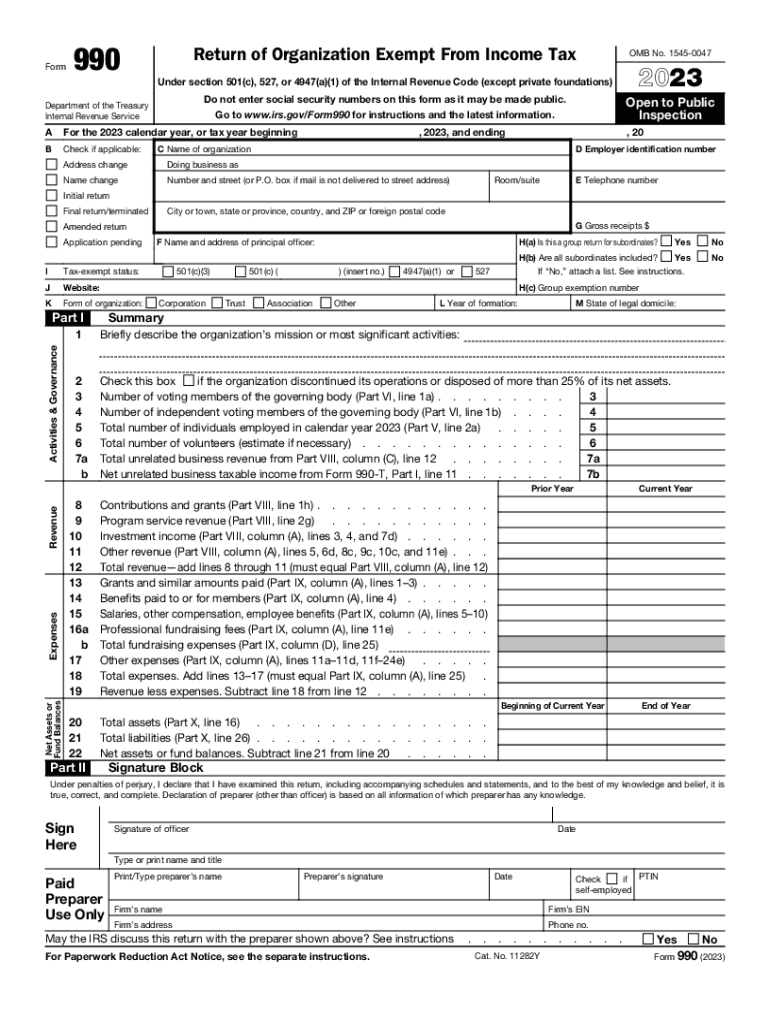

2024 990 Schedule A Tax Form – Some tax-exempt organizations are required to that organizations use to provide supplemental information to Form 990 is Schedule O. All pages of Form 990 are available on the IRS website. . Only available to the smallest of non-profit organizations, Form 990-N is the simplest form of tax reporting for tax-exempt groups. Organizations with usual receipts of $50,000 or less file Form .

2024 990 Schedule A Tax Form

Source : www.file990.org2024 tax calendar Miller Kaplan

Source : www.millerkaplan.comCrysta Tyus, EA

Source : www.facebook.comCatholicHealthAssoc on X: “📆 Don’t miss our informative #IRS990

Source : twitter.comUnderstanding the IRS Form 990 Foundation Group®

Source : www.501c3.org2023 Form IRS 990 Schedule D Fill Online, Printable, Fillable

Source : 990-schedule-d.pdffiller.comDr. Ivy Beckham, CPA, EA posted on LinkedIn

Source : www.linkedin.comIRS 990 Or 990 EZ Schedule E 2020 2024 Fill out Tax Template

Source : www.uslegalforms.comTax Due Dates For 2024 (Including Estimated Taxes)

Source : thecollegeinvestor.com2023 Form IRS 990 Fill Online, Printable, Fillable, Blank pdfFiller

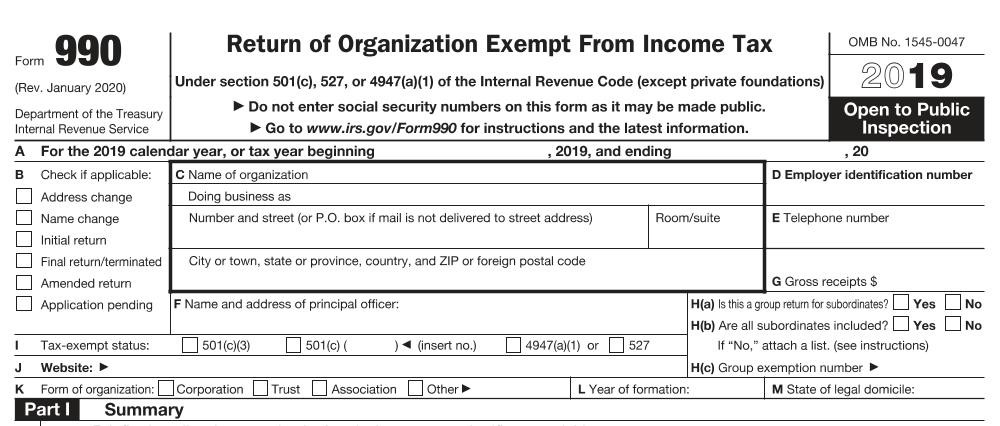

Source : form-990.pdffiller.com2024 990 Schedule A Tax Form IRS Form 990EZ Deadline: Important Information for 2024: You’ll be asked to sign into your Forbes account. Form 990 is a required filing that creates significant transparency for exempt organizations. In 1971, it was harder to get your hands on a Form . And depending on the type of organization you are forming, you will also need to fill out one of the attached schedules (e.g., Schedule Form 990 Return of Organization Exempt From Income Tax.” .

]]>

More Stories

Awd 2024 Cars Reviews

Rrb Recruitment 2024

Camden Cup 2024 Tv